georgia property tax exemption for certain charities measure

However due to a 2009 Court decision regarding GCN member Nuçis Space in Athens Georgia changes to the definition of organizations of purely public charity could have had drastic effects on many. 1 The property is committed to and held in good faith for an exempt use.

3 2020 General Outcome.

. The California Legislature has the authority to exempt property 1 used exclusively for religious hospital or charitable purposes and 2 owned or held in trust by nonprofit organizations operating for those purposes. Keep in mind that this number is specific to the Jones Family. Property Tax Exemption for Certain Charities Measure.

Georgia exempts a property owner from paying property tax on. The measure expanded the property tax exemption for property owned by charitable organizations to include buildings used to secure income used exclusively for the. Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which.

People who are 65 or older can get a 4000 exemption from county taxes in cases when the individual and their spouse dont have an income larger than 10000 for the previous year. As anyone who has run a charity can tell you the IRS designation of a 501c3 non-profit doesnt necessarily apply to all of the non-IRS taxes that are. Expand an exemption for agricultural equipment and certain farm products.

Any Georgia resident can be granted a 2000 exemption from county and school taxes. Sept 28 2020. Tanenbaums practice consists primarily of planning and structuring tax efficient solutions for cross-border business transactions and investments by foreign multinational corporations and.

When nonprofit organizations engage in selling tangible personal property at retail they are required to comply with provisions of the Act relating to. In general Georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations. 1 A Except as provided in this paragraph all public property.

Items of personal property used in the home if not held for sale rental or other commercial use. Shall the act be approved which provides an exemption from ad valorem taxes for all real property owned by a purely public charity if such charity is exempt from. This exemption is known as the Welfare Exemption and was first adopted by voters as a constitutional.

These organizations are required to pay the tax on all purchases of tangible personal property. Path to the ballot The measure was sponsored by Republican Repre. Individuals 65 Years of Age and Older.

Nonprofit organizations rely on property and sales tax exemptions to provide vital services to their clients many of whom are those most in need. Property Tax Exemption for Certain Charities Measure. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases.

How did this measure get on the ballot. Their propertys value is around 65000 which is the median for that locale. Georgia exempts a property owner from paying property tax on.

This referendum will provide an exemption from property taxes for property owned by a public charity that is already exempt from federal taxes under Section 501c3 --. In order to qualify for one of the exemptions the property must not be used for the purpose of. Ballot language and constitutional changes This measure exempts.

The measure expanded the property tax exemption for property owned by charitable organizations to include buildings used to secure income used exclusively for the. The Georgia Code grants several exemptions from property tax. It was approved.

The Georgia Property Tax Exemptions Referendum also known as Referendum 1 was on the ballot in Georgia on November 4 1986 as a legislatively referred state statute. 4000 off school taxes. Here the property tax rate is 093.

Part 1 - TAX EXEMPTIONS. The measure exempted tangible personal property. Georgia Ballot Measure - Referendum A.

GA Code 48-5-41 2014 a The following property shall be exempt from all ad valorem property taxes in this state. City of Atlanta v. Edward Tanenbaum is co-chair of the firms Federal International Tax Group and a member of the firms Global Resources Strategies Committee.

The Welfare Exemption. Failed July 31 2012. New signed into law May 2018.

All tools and implements of trade of manual laborers in an amount not to exceed 2500 in actual value. 7000 off recreation taxes. Standard Homestead Exemption The home of each resident of Georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness.

What does this measure do. The following list sets forth the property tax exemptions that are most likely to be used by Georgia nonprofit organizations. Transportation - Special-Purpose Local-Option Sales Tax - Georgia Mountains District.

Georgia voters in November will help decide the fate of government fees and lawsuits as well as property tax breaks for. The Georgia Charitable Institutions Tax Exemptions Referendum also known as Referendum C was on the November 7 2006 ballot in Georgia as a legislatively referred state statute where it was approved. HB 498 - Proposition 2.

What types of real property have been granted an exemption from Georgias property tax. 63000 x 00093 58590. Therefore the Joneses would calculate their annual property tax in the following way.

B No public real property which is owned by a political subdivision of this state and which is situated. 2 Acquisition of the property is reasonable and proporionate to the future needs of the tax-exempt entity. Enacted in 1877 the exemption for property owned by a charity was not available if the property was used for any type of private or corporate income-producing activity whether the activity was chari-table or non-charitable5 After passage of the Georgia Constitution of 1945 the legislature amended the exemption statute to.

Domestic animals in an amount not to exceed 300 in actual value. 48-5-41 - Property exempt from taxation. 65000 2000 63000.

The Georgia Code grants several exemptions from property tax. Land Held for Future Charitable Use Property acquired by a tax-exempt entity and held for future needs may qualify for exemption if. The 2000 is deducted from the 40 assessed value of the.

Common Types Of Trusts Findlaw

Election 2020 Results Georgia Statewide Referendum A 11alive Com

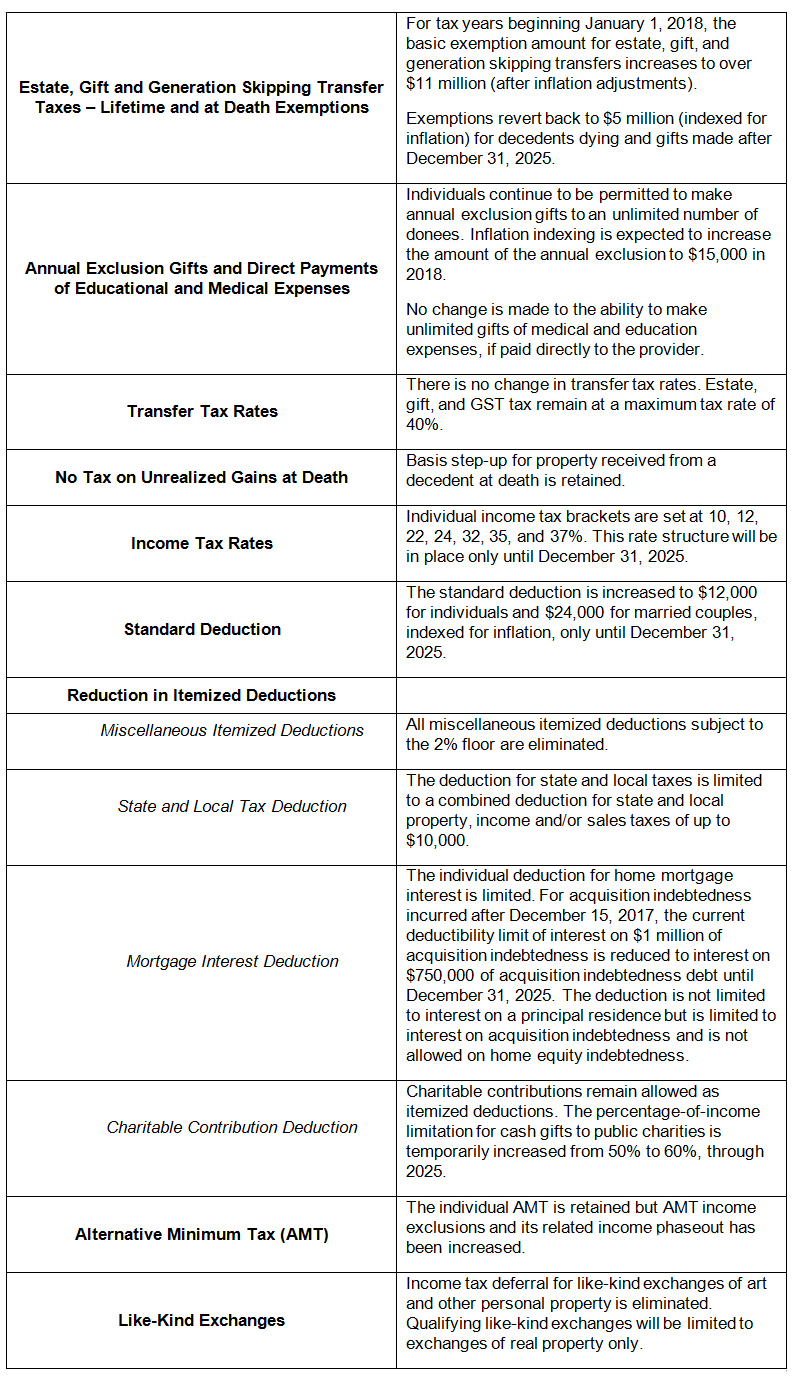

2017 Year End Individual Tax Planning In Light Of New Tax Legislation Steptoe Johnson Llp

3 21 261 Foreign Investment In Real Property Tax Act Firpta Internal Revenue Service

Election 2020 Results Georgia Statewide Referendum A 11alive Com

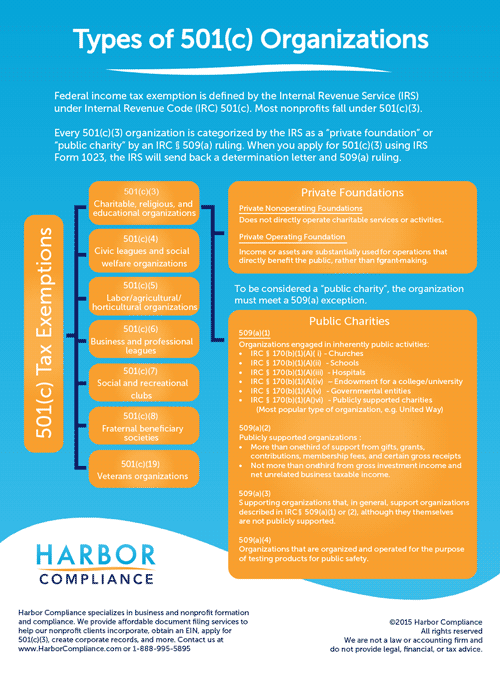

Irs 501 C Subsection Codes For Tax Exempt Organizations Harbor Compliance

What Georgia Amendments Passed In The 2020 Election Firstcoastnews Com

Charitable Lead Trust Vs Charitable Remainder Trust A Comparison Carr Riggs Ingram Cpas And Advisors

How To Get A 300 Irs Tax Deduction For Charitable Donations Money

Georgia 2020 Ballot Measures Ballotpedia

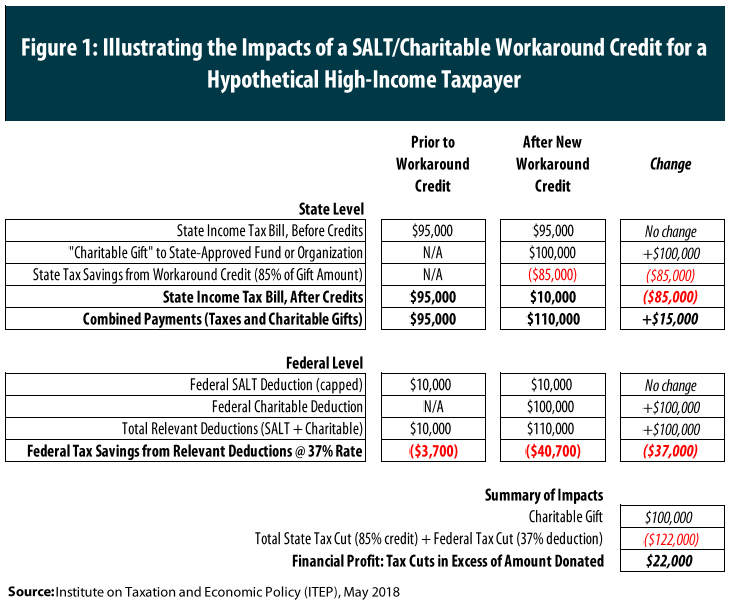

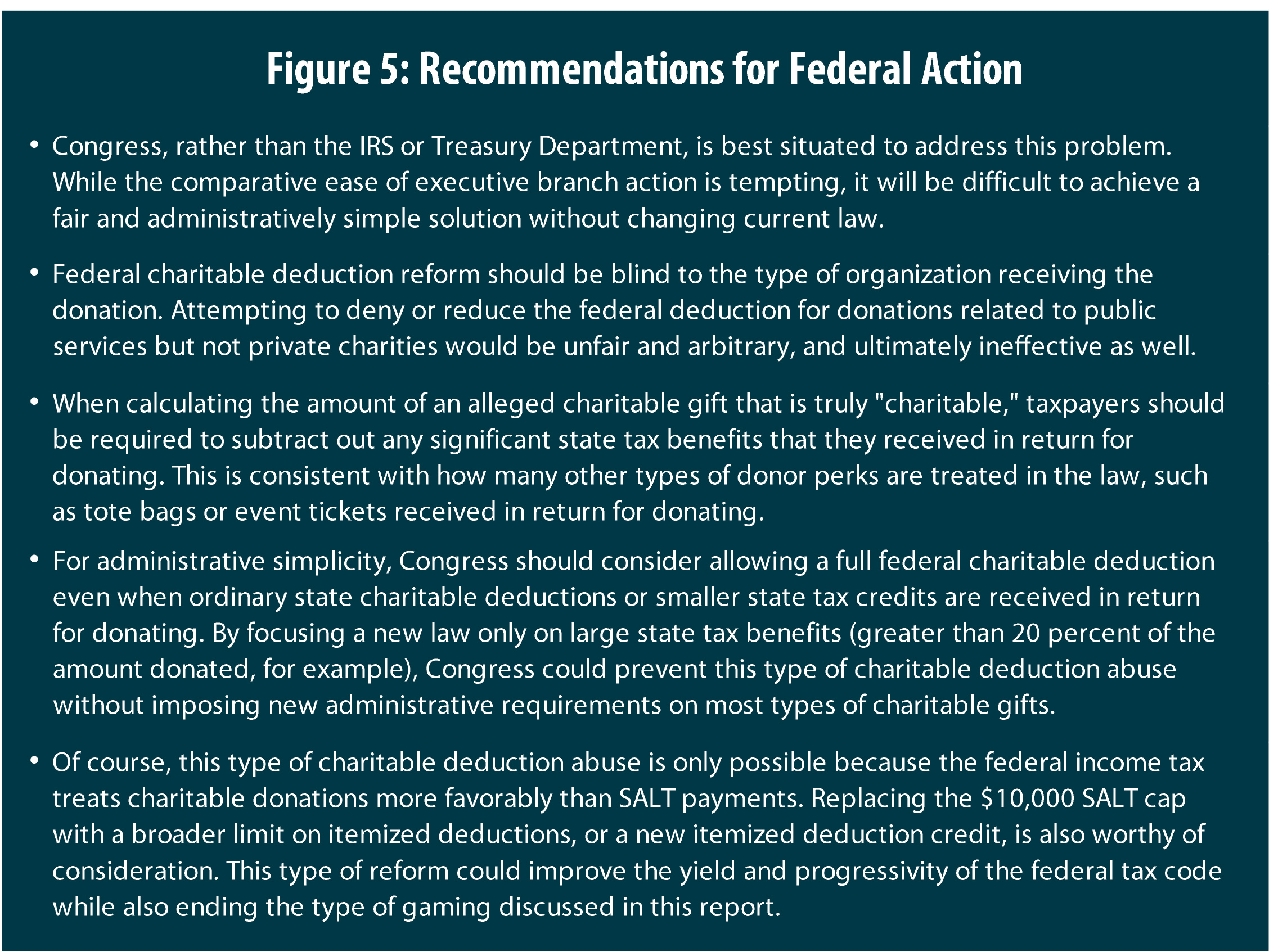

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

Salt Charitable Workaround Credits Require A Broad Fix Not A Narrow One Itep

Cares Act Provisions For Financial Advisors And Their Clients